What is a registered index-linked annuity and how does it work?

It may be the right mix of risk and return potential to supplement your retirement plan.

Protecting savings in turbulent times. Creating lifetime income for a secure retirement. At Athene, we’re always reaching higher so you retire better.

How do you picture retirement? Knowing what you’re working toward can help you and your financial professional create a financial plan to help you achieve your goals.

Athene Holding Ltd. (Athene) is a leading retirement services company that issues, reinsures, and acquires retirement savings products.

It's a great time for you to join one of the leading retirement services companies. Become a Game Changer and help more people make their next life their best life.

Athene USA

7700 Mills Civic Parkway

West Des Moines, IA 50266

Call: 888-ANNUITY (888-266-8489)

8:00 a.m. - 5:00 p.m. CT, Monday - Friday

Fax: 866-709-3922

When the time comes, what will it take to make your retirement remarkable? You want to feel confident the money you've saved will empower you to live the life you’ve always imagined. Whether that means traveling the world or simply enjoying your own backyard, now’s the time to focus on growing your savings to reach your retirement goals.

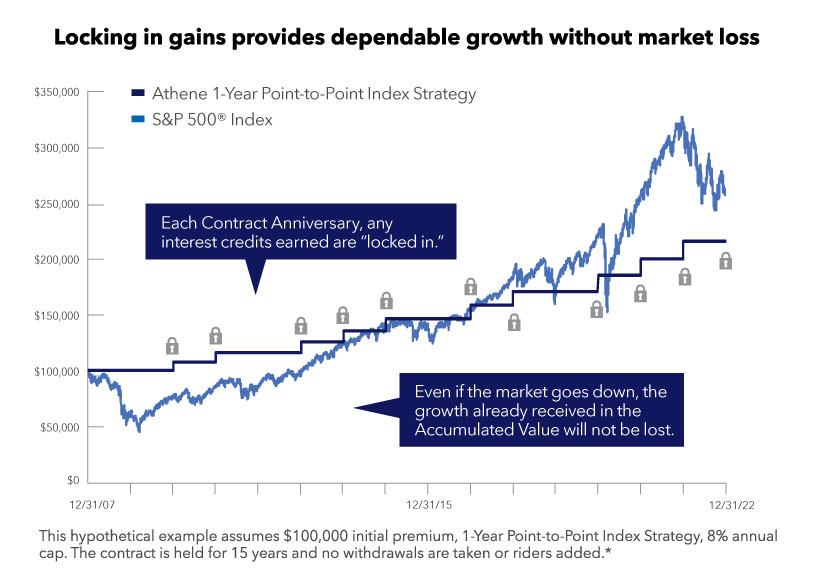

You want your money to keep growing, which is why you might choose to invest it. But with the potential for growth comes the risk of loss as well. A sudden market downturn, like the one we experienced in early 2020, can put your future retirement plan at risk. And the earlier in retirement a market downturn happens, the greater the impact it can have on your retirement savings.

If you're able to use an annuity solution that can decrease your exposure to risk for part of your portfolio and allow the rest of your assets to stay invested and recover with time, the long-term effect of that downturn can be reduced.

How can you help reach your growth goals while reducing the level of risk your money is exposed to?

There are solutions that provide tax-deferred growth potential that is also protected from market downturns.

One of the benefits of an annuity is that your money grows tax-deferred.

The money you use to fund your annuity can impact how your withdrawals are taxed.

The money used to purchase a mutual fund is pooled together from multiple investors and is managed by a financial professional or institution. An annuity is an insurance contract that provides certain guarantees.

| MUTUAL FUND | FIXED INDEXED ANNUITY |

|---|---|

|

|

|

|

|

|

Explore featured products that could help grow your retirement savings. Product features and availability may vary by state and/or sales distributor.

Fixed Indexed Annuities

Annuities with multi-year, index-linked crediting strategies for “patient savers” who want to leverage the long-term potential of the markets.

Fixed Indexed Annuities

Annuities that provide tax-deferred, index-linked growth potential with an optional Legacy Rider (for a charge) that provides enhanced benefits for beneficiaries.

Registered Index-Linked Annuities

Annuities for aggressive savers who are willing to accept a level of market risk in exchange for enhanced index-linked growth potential.

Fixed Indexed Annuities

Annuities that provide tax-deferred, index-linked growth potential for retirement or other long-term savings goals. Optional liquidity features (for a charge) bring added flexibility and peace of mind.

I’m looking for income in retirement

I’m looking to protect what I have

Not sure about your needs? Take this quiz to learn more about how you approach planning for retirement.

It may be the right mix of risk and return potential to supplement your retirement plan.

Annuities contain features, exclusions, limitations and availability that may vary by state and/or sales distributor. For a full explanation of an annuity, please refer to the Certificate of Disclosure or Prospectus (as applicable) and contact your financial professional or the company for costs and complete details. This material is a general description intended for general public use.

Annuity contracts and group annuity contracts are issued by Athene Annuity and Life Company (61689), West Des Moines, IA, in all states (except New York), and in D.C. and P.R. Annuity contracts are issued by Athene Annuity & Life Assurance Company of New York (68039), Pearl River, NY, in New York. Group annuity contracts for New York residents and New York contract holders are issued in New York by Athene Annuity & Life Assurance Company of New York, Pearl River, NY. Payment obligations and guarantees are subject to the financial strength and claims-paying ability of the issuing insurance company. Insurance products may not be available in all states. These companies are not undertaking to provide investment advice for any individual or in any individual situation, and therefore nothing in this should be read as investment advice. This material should not be interpreted as a recommendation by Athene Annuity and Life Company, Athene Annuity & Life Assurance Company of New York, or Athene Securities, LLC. Please reach out to your financial professional if you have any questions about insurance products and their features.

The term “financial professional” is not intended to imply engagement in an advisory business with compensation unrelated to sales. Financial professionals will be paid a commission on the sale of an annuity.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, THE BANK OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

Reinsurance contracts are entered into with Athene Annuity and Life Company (61689), West Des Moines, IA; Athene Annuity & Life Assurance Company (61492), Wilmington, Delaware; Athene Annuity & Life Assurance Company of New York (68039), Pearl River, NY; Athene Life Re Ltd., Hamilton, Bermuda; and Athene Annuity Re Ltd., Hamilton, Bermuda. Not all reinsurance products or structures offered are available in all jurisdictions. Reinsurers may not be licensed in all states. All transactions are subject to meeting a reinsurer’s underwriting requirements. Reinsurance products are not protected or guaranteed by state insurance guaranty associations or insolvency funds.